04/52 Posts for 2021 - Another case for $15

Posted on 2021-01-24 by GeniusMusing — 8 min

Not that we really need more proof it is needed...

and maybe it should be even higher...

TL;DR: If you want to even think about the pursuit of the "American Dream" and get the US economy moving forward, it has to start changes at the bottom not the top and this needs to be done really soon. Now even.

While a Presidential Executive Order does not directly raise the minimum wage to $15/hour, even for federal employees, the request is in for a report for recommendations to get there.

Sec. 5. Progress Toward a Living Wage for Federal Employees. The Director of OPM shall provide a report to the President with recommendations to promote a $15/hour minimum wage for Federal employees.

Let's start this with the pursuit of one part of the "American Dream", owning (or at least owing on) a home. To begin this we must dive into the history of minimum wages, housing prices, and mortgage rates.

For this post I will only be looking at 1971 onward to present and just a little beyond. Why 1971 when minimum wage was actually started back in 1938?

This is due to the data that is available as this post relates to owing a home, mainly the mortgage rate information which was not really collected prior to 1971.

Why is mortgage rate information needed?

For most people that do buy a house it is the single largest purchase they will ever make. It also comes with monthly payments for usually 30 years and the interest added to the cost is not simple interest and it can significantly increase the overall cost of the purchase.

Example: $10,000 car or home loan at 3% interest and a 30 year (360 month) term would have a total cost of $15,177.75 with $5,177.75 in interest. The same loan for a more standard time of 36 months for a vehicle would have only $469.24 in interest due to the shorter term time and the way the interest calculations work. The calculations used were assuming a $10,000 loan with no down payment/taxes/fees/insurance/other.

The numbers below are also calculated this way as taxes for property/schools/city/county and insurance that is usually included in the monthly payment can change year to year and would overly complicate for the purposes here.

Where am I going with this?

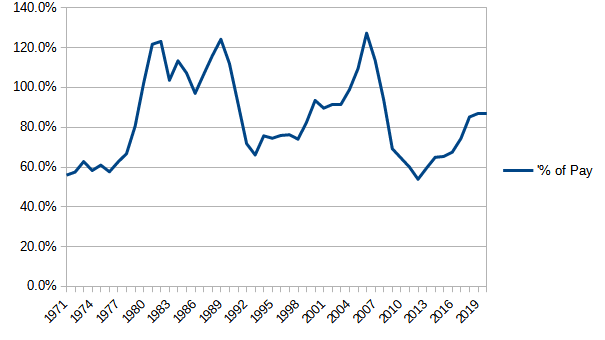

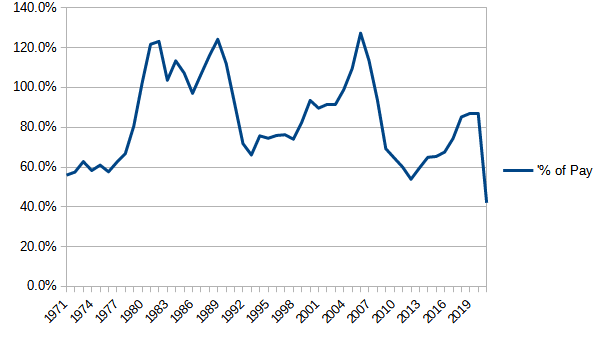

The reality of possibly owning a home with a minimum wage, full time job would be the closest to a possibility since before 1971 with $15/hour rate.

The numbers below represent a single person working a single full time job with no taxes/dues/etc taken out as they also wildly vary by state/city. This is consistent with what is typically looked at when applying for a mortgage, monthly/yearly gross income, monthly payment expected and credit score which helps determine the interest rate you would get. I am not sure if you could actually afford a home on minimum wage for a single person but two incomes would make it more feasible these days compared to prior history. Using 30% of income is the typical way lenders look to qualify people as food/clothes/transportation/utilities/etc take up the difference in a typical monthly paycheck. It also shows just how far off the possibility is.

Year: 1971

Min Wage: $1.60

Monthly Gross Pay at 2000 hours/year: $275.20

Median Home Price: $25,786

Interest Rate: 7.54%

Mortgage balance with 6% down: $24,238.84

Total cost of mortgage: $61,252.52

Monthly Mortgage payment: $170.15

Percent of monthly pay for Mortgage: 61.8%

Years to pay off using 100% of income: 19.1 (The total mortgage cost)

Years to pay off using 30% of income: 63.8

All the other data is worse (2006 was 145.2 years at 30%) with the exception of 2012.

Year: 2012

Min Wage: $7.25

Monthly Gross Pay at 2000 hours/year: $1,247

Median Home Price: $172,416

Interest Rate: 3.66%

Mortgage balance with 6% down: $162,071.04

Total cost of mortgage: $267,236.45

Monthly Mortgage payment: $742.32

Percent of monthly pay for Mortgage: 59.5%

Years to pay off using 100% of income: 18.4 (The total mortgage cost)

Years to pay off using 30% of income: 61.43

Now lets look at the 2020 numbers at the current minimum wage of $7.25/hour.

Year: 2020

Min Wage: $7.25

Monthly Gross Pay at 2000 hours/year: $1,247

Median Home Price: $273,633

Interest Rate: 3.8%

Mortgage balance with 6% down: $257,215.02

Total cost of mortgage: $431,464.43

Monthly Mortgage payment: $1,198.51

Percent of monthly pay for Mortgage: 96.1%

Years to pay off using 100% of income: 29.8 (The total mortgage cost)

Years to pay off using 30% of income: 99.19

Not even close to a possibility but lets look at how those numbers change with $15/hour.

Year: 2021?

Min Wage: $15.00

Monthly Gross Pay at 2000 hours/year: $2,580

Median Home Price: $273,633

Interest Rate: 3.8%

Mortgage balance with 6% down: $257,215.02

Total cost of mortgage: $431,464.43

Monthly Mortgage payment: $1,198.51

Percent of monthly pay for Mortgage: 46.5%

Years to pay off using 100% of income: 14.4 (The total mortgage cost)

Years to pay off using 30% of income: 47.94

These are the best numbers of all, in part due to the low interest rates of today and the roughly doubling of minimum wage.

While this is focused on the purchase of a home, it applies to rent for the very same reason that a large percentage of income is being used just for a place to stay and sleep, and now I guess work and everything else. I would have added median rent data but I could only find data relating to cities and not overall median for the country.

There are many cities/counties (27 as of Jan 2021 with more coming later this year) where the minimum wage is currently at or beyond $15 and businesses are still going barring anything related to the current pandemic, which has not been taken into account as the data is not easily accessible on a overall level.

The other thing I have seen is that minimum wage kept pace with productivity which it did from 1938 to 1968 before breaking with much higher productivity and stagnation of the minimum wage. If it had continued to follow, the minimum wage would be over $24/hour.

Also as a footnote of sorts, if the minimum wage was as $24/hour, using the 2020 numbers, you could actually buy a $273,633 house and use just less than 30% (29%) of your monthly gross income and pay it off in 29.96 years.

I can already hear your thoughts about "What will business's do when it cost them more?" questions and the real answer is they will do what they always have the same as when rent/supplies/products/taxes/etc cost more, things will cost more but it shouldn't cost that much more. Some of the research that has already been done.

What Happened When These Places Raised the Minimum Wage to $15

snip

The Potential Downsides of an Increased Minimum Wage

A higher minimum wage could have negative repercussions for both workers and employers, according to the CBO analysis. The CBO estimated that 1.3 million Americans could lose their jobs if a wage hike were enacted, although some economists believe the actual number would be much lower.

The CBO also said that an increase in the minimum wage would “reduce business income and raise prices” as companies pass on the higher costs of labor to consumers. In addition, it could slightly reduce the U.S.’s total output.

Some Research Disputes the CBO Findings

Although the CBO predicts that raising the minimum wage would have negative effects on employment, some research contradicts these findings. A 2019 study by UC Berkeley’s Center on Wage and Employment Dynamics looked at sub-state wage variations that would echo what would happen if the minimum wage moved closer to the median wage across the U.S.

According to a press release, the study “did not detect adverse effects on employment, weeks worked or weekly hours among workers with a high school degree or less.”

“The results of our research show that we can raise pay to $15, even in low-cost states,” said Anna Godoey, one of the study authors, in the press release. “The data show that the minimum wage has positive effects, especially in areas where the highest proportion of workers received minimum wage increases. We also found reduced household and child poverty in such counties.”

snip

And what is really more important, people or profits?

I might just save that thought for a different blog entry.

Charts:

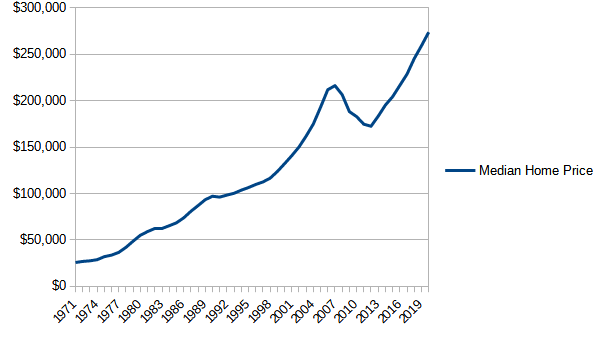

Median House Price

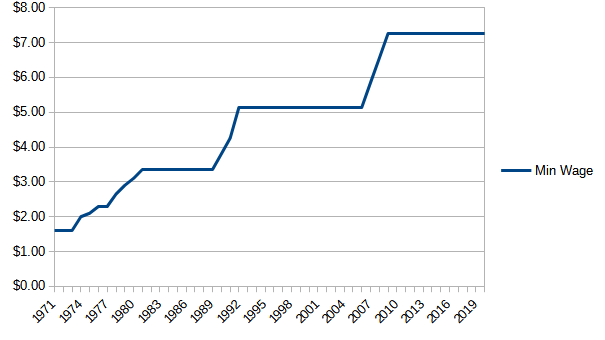

Federal Minimum Wage

Percentage of Pay

Percentage of Pay with $15

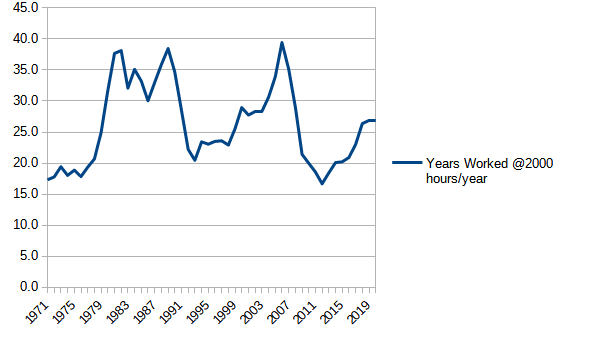

Years at 2000 hours a year to pay offYears at 2000 hours a year to pay off

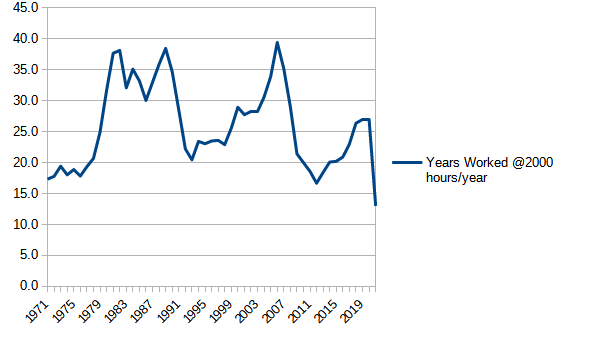

Years at 2000 hours a year to pay off with $15

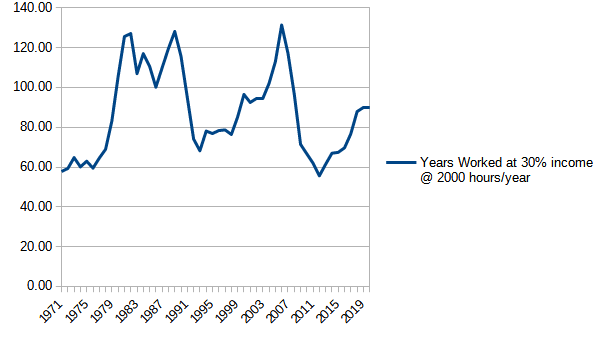

Years at 2000 hours a year to pay off using 30% of pay

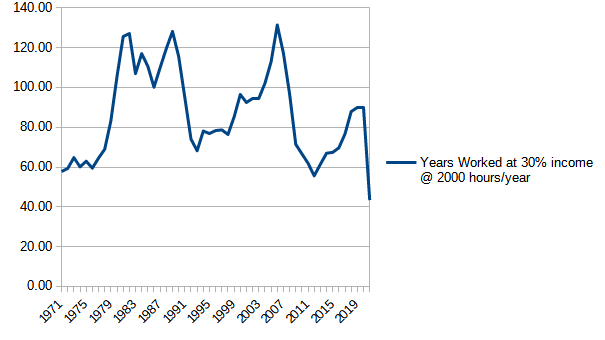

Years at 2000 hours a year to pay off using 30% of pay with $15

Data Sources:

Historical Home Prices: US Monthly Median from 1953-2020 DQYDJ

History of Federal Minimum Wage Rates Under the Fair Labor Standards Act, 1938 2009 U.S. Department of Labor

Historical Mortgage Rates: Averages and Trends from the 1970s to 2020 ValuePenguin

What's the Average Down Payment on a House The Lenders Network

Auto Loan Calculator

Mortgage Calculator

Data Files:

Data in HTML

Data in ODF